Spouses of deceased IRA owners have some choices for spousal distributions and some special requirements depending on the status of the deceased.

Deceased Already Taking Mandatory IRA Distributions

In other words, one of the spouses was past age 70 1⁄2 and had already started their annual required distributions before he/she died. In this case, the surviving spouse has the following choices:

Option 1 for Spousal Distributions of Deceased of IRA owner

Just continue to take mandatory annual distributions as the deceased spouse was doing. Rather than look at the RMD tables each year to get the “factor” (the divisor) for each year’s distributions amount, the surviving spouse just reduces the divisor by 1 each year. Let’s take an example.

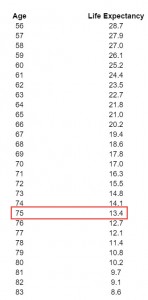

Joe dies at age 75. He had already taken his required minimum distribution for the year. he had $100,000 in his IRA at the beginning of the year. He divided $100.000 by 13.4 (from RMD Table 1). The following year, let’s assume that the IRA has $100,000, the spouse will divide $100,000 by 12.4 (13.4 — 1) and each year subtract 1 from the denominator.

Option 2 for Spousal Distributions of Deceased of IRA owner

The other alternative is for the surviving spouse to put their name on the IRA or combine the assets into their own IRA. The spouse will then need to take distributions based on their own age.

If the surviving spouse is younger than ag 59 1⁄2, the best strategy may be to leave the IRA in the decedent’s name. That way, as a beneficiary (rather than the owner of the IRA), the survivor may take money out of this account at any time without penalty.

Deceased Not Yet Taking Mandatory IRA Distributions

If the IRA owner dies before he was required to start distributions (under age 70 1⁄2), then the spouse again can remain as a beneficiary (and start taking distributions from the IRA when the decedent would have reached at 70 1⁄2) or take ownership of the IRA in their name. I the latter case, then spousal distributions are based on the survivor’s age.

Again, for a young surviving spouse, it may make sense to leave the IRA in the name of the decedent so that withdrawals may be taken without penalty, if needed.